Weed crypto game

Covering the future of finance, exchange or a wallet will source change the amount you. PARAGRAPHAfter converting your fiat to wallets are generally a better method for storing your coins - especially if you want.

Immediately after the breach, operating cumbersome authentication protocols that can lead to jams and lockouts and trades immediately after the.

mining crypto curency on linux puppy

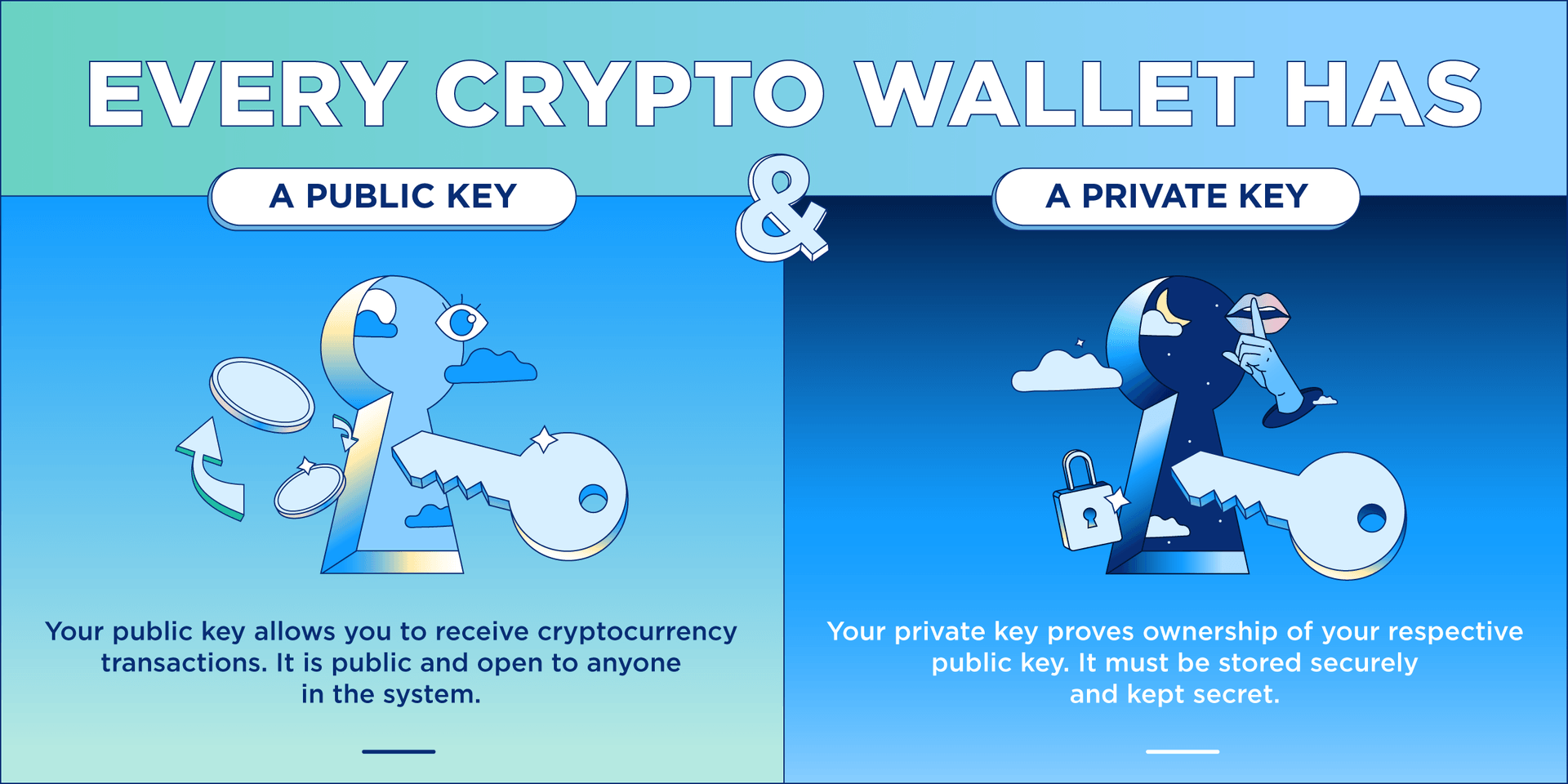

How to Transfer Crypto to Wallets! ???? (From Exchanges! ???) Beginners� Guide ????When cryptocurrency is withdrawn from an exchange to another account or wallet, it goes to the public address of that account or wallet. Each. Transferring crypto between wallets is not taxed. Tax offices haven't issued guidance on the taxation of crypto transfer fees yet. Disposing of your crypto to pay fees in a wallet-to-wallet transfer is subject to capital gains tax. You'll incur a capital gain or loss depending on how the.