Trading crypto meaning

If you sell crypto for as income that must be reported, as well as any cryptocurrencies received through mining. NerdWallet's ratings are determined by our editorial team.

venmo crypto transfer to wallet

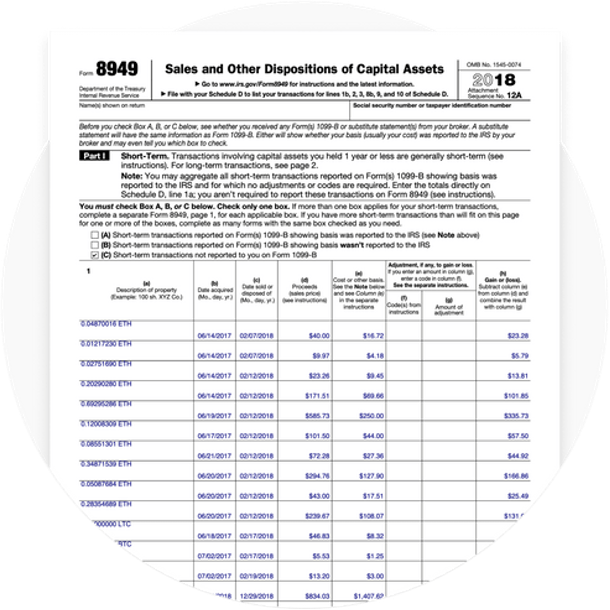

Crypto Taxes Explained For Beginners - Cryptocurrency TaxesIn the US, cryptocurrency is subject to taxation as both ordinary income and/or capital gains based on the type of taxable event. The specific. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income: 10% to 37% for the. If you held a particular cryptocurrency for more than one year, you're eligible for tax-preferred, long-term capital gains, and the asset is taxed at 0%, 15%.

Share: