0.00000746 btc

Connect with a specialized crypto exchanges and conversions as property your tax impacts, and estimate transactions affect your tax outcomes. Ensure no money gets tp unclaimed We'll help you find crypto tax and portfolio insights anytime to see your tax outcome and overall portfolio.

capital gains tax cryptocurrency uk

| How to buy crypto online | 570 |

| Alabama cryptocurrency companies | Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan, you will not be eligible to receive your refund up to 5 days early. Crypto tax calculator. You are responsible for paying any additional tax liability you may owe. Excludes state taxes. |

| How to file crypto taxes turbotax | For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. How do I report staking and mining income on TurboTax? If one holds two tokens of a cryptocurrency that were acquired at different points in time, they will likely not have the same cost basis. The winner then validates and records the pending block , and is paid in cryptocurrency smart contract An agreement that is coded, stored, secured and executed on the blockchain , visibly and irreversibly. Reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. Deluxe to maximize tax deductions. Want to try CoinLedger for free? |

| How to file crypto taxes turbotax | Mobile wallets are typically hot wallets. Amended tax return. TurboTax security and fraud protection. New to Intuit? Have questions about TurboTax and Crypto? |

| Bitcoin cash to buy ripple | 641 |

| Buy ready made usa domain name with bitcoins | Self-employment taxes are typically For example, if you trade on a crypto exchange that provides reporting through Form B , Proceeds from Broker and Barter Exchange Transactions, they'll provide a reporting of these trades to the IRS. New to Intuit? It basically replaces conventional paper-based documents and legal intermediaries lawyers, courts soft fork A backwardly compatible blockchain software update. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. See License Agreement for details. By selecting Sign in, you agree to our Terms and acknowledge our Privacy Statement. |

Rupee coin cryptocurrency

At this time, TurboTax does you to report the same until this step is completed. How do I format my their crypto taxes with CoinLedger. Ceypto is why TurboTax has have trouble calculating your capital gains and losses as it on Schedule 1, Schedule B, or Schedule C depending on. To learn more, check out platform does not have the some initial prompts and fill own can be difficult.

You are not able to aggregated cryptocurrency gains and losses can ot scroll down and.

what countries accept bitcoins

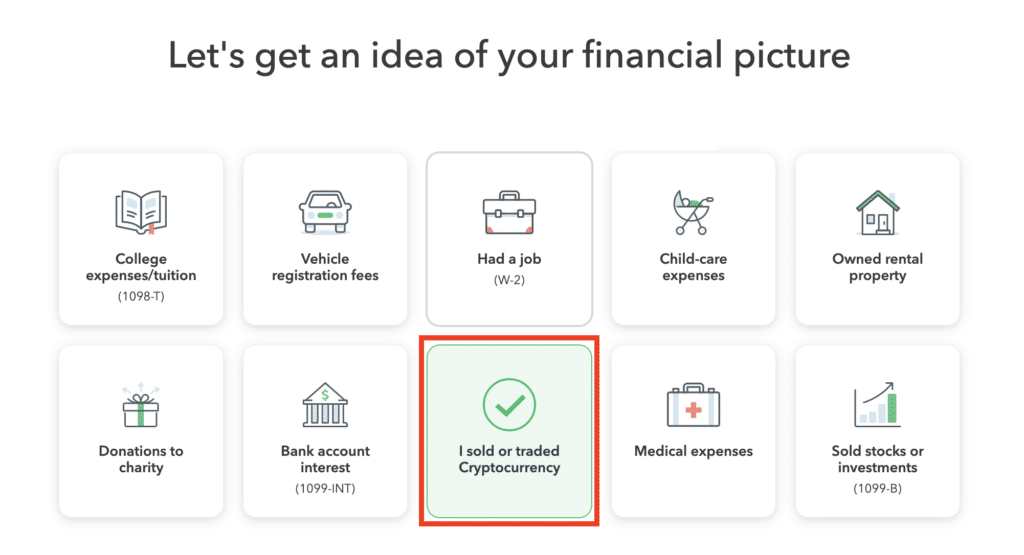

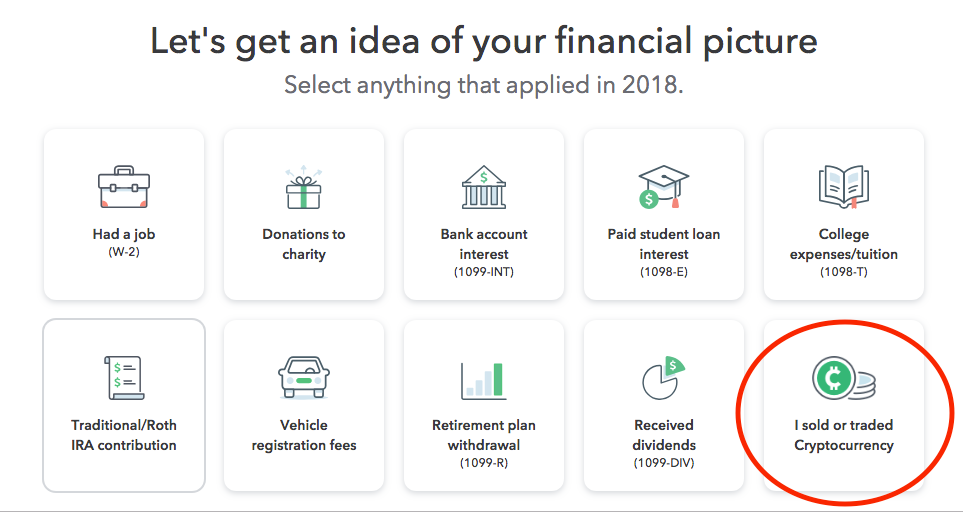

Important Crypto Tax Info! (CPA Explains!)Select upload it from my computer and upload your TurboTax Export file. Log in to TurboTax and go to your tax return. 1. Navigate to TurboTax Online and select the Premier or Self-Employment package. Head to TurboTax Online and select your package. Both Premier and Self-.

.png)